Now that the "not a bailout, but a buy-in" deal is done, the financial market will hopefully begin the long unwinding process started by the sub-prime mortage mess in a more orderly fashion. Let's say you are one of those investors who went long on cash last Summer and are sitting on a pile of cash. Now may not yet be the time to jump back in, but it may be time to start looking.

While it is not a good idea to try to time the market, it would at least make sense to think about what to buy when it is time to get back in the game. We like things simple. No matter how complicated the world gets, there are the three constants: everyone has to eat, most like to have some fun, and nobody lives forever.

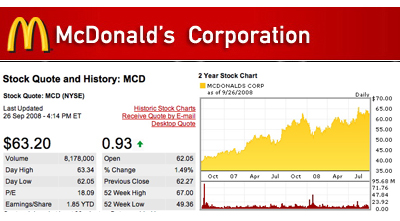

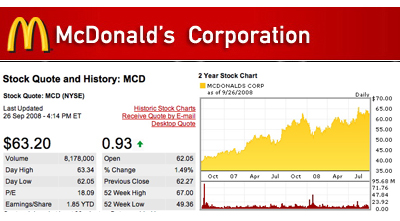

When money is tight, value is king. We like what we heard about McDonanld's plans for China. This is where we would put our money if we don't have to touch it for the next five years.

Companies which are involved with creating "fun" actually work REALLY hard. It used to be a couple of guys can put out a FPS game on the Web and make a name for themselves. Those days are long gone. A profitable video game now take a team of programmers, motion capture equipment, illustrators, and a story line. However, a hit game can be the start of a very profitable franchise. Companies such as Electronic Arts (ERTS) and TakeTwo Internactive Software (TTWO) are both in for the long haul. We go a glimpse of a "game changer" three years ago. The game is now finally on the market. Those interested should take a look at this.

When we say "nobody lives forever," we don't mean we are thinking of investing in funeral homes. There will be companies like Genentech, Genzyme, and Amgen who exploded onto the market with life-changing products. However, blockbuster drug discovery will always be a process requiring deep pockets, long timelines, and lots of PhDs. There are just no ways around it, regardless of the hype. While there are still lots of profit potentials by investing in biotech tool companies (bioinformatics, microfluidics, DNA chips), in the end it is all about the patient. Where would we invest when it comes to this last area? Interested readers will just have to wait until the next installment of MoneyMonday :-) [Permalink] - Where To Invest?

|